Category

Articles in

Yurtdışında Şirket Kurma Rehberi: Freelancer için En İyi Seçenekler 2025

2025 yılında Türk freelancer'lar için yurtdışında şirket kurmak artık bir lüks değil, stratejik bir zorunluluk. Doğru ülkede şirket kurarak vergi yükünüzü %60'a kadar azaltabilirsiniz

What is a Virtual Company? The Complete Guide to Virtual Business Operations in 2025

The virtual company model represents a fundamental shift in how businesses operate in the digital age.

What are the company benefits in the UK and how to company formation in the UK?

The United Kingdom is an attractive destination for entrepreneurs and investors looking to establish a business due to its stable economy, skilled workforce, and global market access.

What Is a Sole Trader? Definition, Tax, and How It Differs From a Limited Company

What is a sole trader? Learn the definition, tax rules, VAT threshold, advantages, and how sole traders differ from limited companies or freelancers in the UK.

Sole Trader vs. Freelancer: Which Is Right for You?

How to Incorporate Your Freelance Business Abroad: Europe Guide 2025

In 2025, incorporating your freelance business in Europe isn't just a dream—it's a strategic necessity for growth. Save up to 60% on taxes by incorporating in the right EU country.

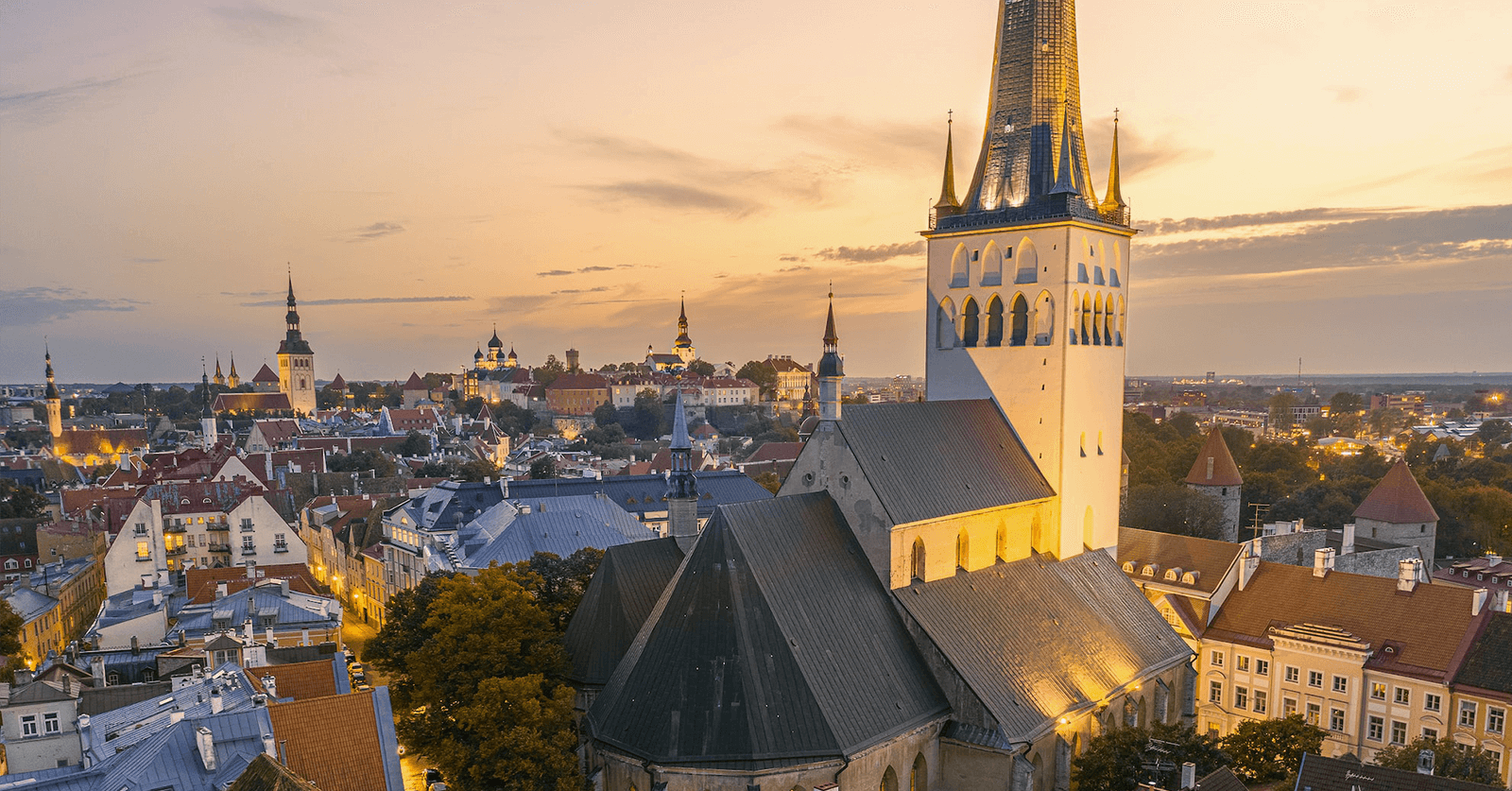

E-Residency and Company Formation in Estonia: A Comprehensive Guide

Estonia, a small Baltic nation in Northern Europe, has become a hub for digital innovation and entrepreneurship. One of its groundbreaking initiatives is e-residency, a digital identity program that has attracted entrepreneurs from around the globe.

2025’te Freelancer Olarak Şirket Açmalı mıyım?

Şirket açmalı mıyım? KDV öder miyim? 2025’te freelancer olarak çalışırken vergi, fatura ve yurt dışı ödemeleriyle ilgili en güncel bilgileri bu yazıda topladık. Gerçek içgörülerle, sade karşılaştırmalarla.