Introduction: Why Bulgaria is the Smart Choice for Digital Nomads in 2025

Bulgaria has quietly become one of Europe's most attractive destinations for digital nomads and remote workers. With living costs 50-60% lower than Western Europe, a thriving digital nomad community, and surprisingly straightforward banking options, this Balkan country offers an unbeatable combination of affordability and quality of life.

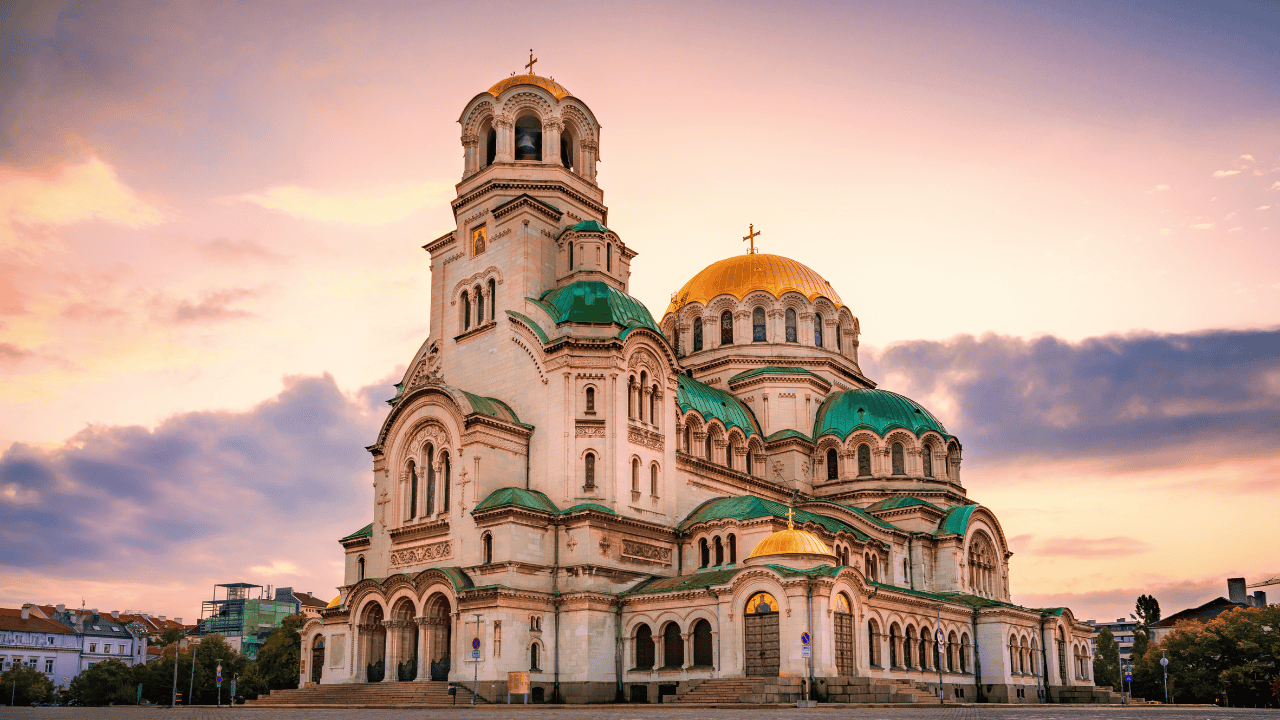

Whether you're considering Sofia's vibrant tech scene, Varna's beach lifestyle, or Plovdiv's cultural richness, this comprehensive guide covers everything you need to know about the cost of living in Bulgaria and how to set up your banking infrastructure as a freelancer or remote worker.

Understanding Bulgaria's Cost of Living: The Real Numbers

Bulgaria consistently ranks as one of the most affordable countries in the European Union, but what does that actually mean for your monthly budget? Let's break down the realistic costs you can expect across different aspects of daily life.

Housing Costs Across Bulgarian Cities

Sofia (Capital City)

Rent represents your largest monthly expense in Sofia, but it remains remarkably affordable compared to other European capitals. A modern one-bedroom apartment in the city center typically costs between €400-600 per month, while the same apartment in suburban neighborhoods drops to €300-450. For those seeking more space, two-bedroom apartments in central areas range from €600-900, with suburban options available for €450-650.

If you're planning a shorter stay, furnished apartments designed for digital nomads are widely available through platforms like Airbnb and local rental sites, typically costing €600-1,000 per month for central locations with all utilities included. Many landlords now cater specifically to remote workers, offering apartments with dedicated workspace, high-speed internet, and flexible lease terms.

Varna (Black Sea Coast)

Varna offers a unique proposition for digital nomads seeking a beach lifestyle without the Mediterranean price tag. Summer months (June-September) see rental prices peak, with one-bedroom apartments in central or beachfront areas costing €500-750. However, off-season prices drop dramatically—the same apartments can be found for €300-500 from October through May.

This seasonal variation creates an interesting opportunity for long-term digital nomads who can negotiate annual contracts at significantly reduced rates, often 30-40% below peak summer pricing. Many landlords prefer year-round tenants and will offer substantial discounts to avoid seasonal vacancies.

Plovdiv (Cultural Hub)

As Bulgaria's second-largest city and cultural capital, Plovdiv strikes an excellent balance between urban amenities and affordability. Rent here typically runs 15-25% cheaper than Sofia, with one-bedroom apartments in the historic Old Town or trendy Kapana district costing €350-550. The lower cost of living, combined with a thriving arts scene and strong expat community, makes Plovdiv particularly attractive for creative freelancers and digital nomads prioritizing quality of life over career networking opportunities.

Food and Dining Expenses

Bulgarian cuisine is hearty, delicious, and incredibly affordable. Your monthly food budget will vary significantly based on whether you cook at home or eat out regularly, but even restaurant dining remains accessible on a modest budget.

Grocery Shopping

A well-stocked weekly grocery shop for one person typically costs €30-50, translating to roughly €120-200 per month. Local markets (pazars) offer fresh produce at even lower prices than supermarkets—you can easily fill a bag with seasonal vegetables and fruits for €5-10. Bulgarian yogurt, cheese, and bread are both excellent quality and remarkably cheap, with a kilogram of white cheese (sirene) costing around €5-7 and fresh bread available for less than €1 per loaf.

For digital nomads accustomed to Western European or North American prices, the savings are dramatic. A monthly grocery budget that would barely cover two weeks in London or Amsterdam can provide abundant, high-quality food for an entire month in Bulgaria.

Restaurant and Café Culture

Bulgaria's restaurant scene offers exceptional value, especially outside tourist areas. A substantial lunch at a traditional mehana (tavern) costs €5-8, including a main course, salad, and drink. Modern bistros and international restaurants in Sofia's city center charge €8-15 for main courses, while similar meals in Western European capitals would cost €15-25.

Coffee culture is strong in Bulgarian cities, with excellent espresso drinks available for €1-2 at local cafés. Co-working spaces and digital nomad-friendly cafés typically charge similar prices, making it affordable to work from different locations throughout the day. A cappuccino that costs €5 in London or €4 in Berlin will run you €1.50-2 in Sofia.

Transportation Costs

Getting around Bulgarian cities is both easy and inexpensive, with multiple options to suit different preferences and budgets.

Public Transportation

Sofia's metro, tram, and bus system is modern, efficient, and absurdly cheap by European standards. A single journey costs just €0.80, while a monthly unlimited pass costs only €24. This means you can travel throughout the city as much as you want for less than the cost of three days of London Underground travel.

Varna and Plovdiv rely primarily on buses and trolleybuses, with similarly low fares. Monthly passes in these cities cost around €20-25, making public transportation essentially a negligible expense in your monthly budget.

Ridesharing and Taxis

Uber, Bolt, and local taxi services operate throughout Bulgarian cities at prices that will shock anyone coming from Western Europe or North America. A typical 5-kilometer ride in Sofia costs €3-5, while a 20-minute journey across the city rarely exceeds €8-10. For digital nomads working late or carrying equipment, the affordability of ridesharing makes it a viable daily transportation option rather than an occasional luxury.

Car Ownership and Rentals

If you plan to explore Bulgaria extensively, car rental rates are competitive, starting around €15-25 per day for economy vehicles. Fuel costs approximately €1.40-1.60 per liter, which is lower than most EU countries but higher than you might expect given Bulgaria's overall affordability. Parking in city centers typically costs €0.50-1 per hour, with many residential areas offering free street parking.

Utilities and Internet Connectivity

For remote workers and digital nomads, reliable internet connectivity isn't a luxury—it's a necessity. Bulgaria delivers exceptionally well on this front, combining high-speed connections with low costs.

Internet and Mobile Services

Bulgaria consistently ranks among the countries with the fastest and cheapest internet in Europe. A high-speed fiber optic connection (300-1000 Mbps) typically costs €10-20 per month, often bundled with cable TV and phone service for €25-35 total. Most rental apartments in cities include internet in the rent or have existing connections that new tenants can simply take over.

Mobile phone plans are equally affordable, with unlimited data packages available for €10-15 per month from providers like Vivacom, Yettel, and A1. Many digital nomads opt for prepaid SIM cards, which offer excellent flexibility—you can get 50GB of data for around €8-10 monthly.

Electricity, Water, and Heating

Utility costs in Bulgaria vary significantly by season, with winter heating representing the largest variable expense. For a one-bedroom apartment, expect monthly utility bills of:

Summer months (May-September): €40-70 total, covering electricity, water, and building maintenance fees. The mild Mediterranean-influenced climate means minimal cooling costs.

Winter months (November-March): €100-180 total, with heating being the primary driver. Apartments with central heating (топлофикация) typically cost less to heat than those relying on electric radiators or air conditioning units. If you're house hunting, inquire about heating systems—central heating generally offers better value for winter months.

Many digital nomads strategically time their stay in Bulgaria to avoid the coldest months, or they choose apartments with efficient heating systems and good insulation to minimize winter utility costs.

Healthcare and Insurance

Bulgaria offers both public healthcare (extremely affordable) and private medical services (still cheap by international standards), giving digital nomads flexibility in how they manage their healthcare needs.

Public Healthcare System

EU citizens with a European Health Insurance Card (EHIC) can access Bulgaria's public healthcare system. The quality varies—Sofia and other major cities have well-equipped public hospitals, though language barriers can be challenging as many doctors speak limited English.

Private Healthcare

Most expats and digital nomads in Bulgaria opt for private healthcare, which offers English-speaking doctors, shorter wait times, and modern facilities at prices that remain affordable. A standard consultation with a private general practitioner costs €20-40, while specialist visits range from €30-60. Many private clinics offer package deals for regular checkups and preventive care.

Comprehensive private health insurance through Bulgarian providers costs approximately €40-80 per month for basic coverage, or €100-150 for premium plans with extensive coverage. International health insurance providers also offer Bulgaria-specific or Europe-wide plans starting around €80-120 monthly.

For digital nomads planning to stay longer term, combining Bulgarian private insurance with an international plan that covers emergency medical evacuation and treatment in other countries often provides the best balance of affordability and comprehensive coverage.

Entertainment and Lifestyle Costs

Bulgaria offers a rich cultural life and varied entertainment options at prices that allow digital nomads to enjoy regular outings without budget stress.

Fitness and Wellness

Gym memberships in Bulgarian cities are remarkably affordable compared to Western Europe. Premium gyms in Sofia with modern equipment, classes, and pools charge €30-50 per month, while budget chains offer basic facilities for €15-25 monthly. Yoga studios, CrossFit boxes, and specialized fitness centers typically charge €40-70 for unlimited monthly classes.

Bulgaria has a strong spa and wellness culture, with many cities featuring thermal springs and wellness centers. A massage or spa treatment that would cost €80-100 in Western Europe runs €20-40 in Bulgaria, making regular wellness treatments accessible on a typical digital nomad budget.

Cultural Activities and Entertainment

Sofia, Plovdiv, and other Bulgarian cities offer vibrant cultural scenes at accessible prices. Theater tickets cost €5-15, classical music concerts €10-25, and cinema tickets around €5-7 (with special weekday discounts often available). Museums and galleries typically charge €3-6 for entry, with many offering free admission days.

The craft beer and cocktail scene has exploded in Bulgarian cities over the past few years, with excellent bars offering drinks at €2-4 for craft beer and €5-8 for cocktails. Live music venues, from jazz clubs to electronic music spaces, typically charge €5-15 for entry.

Weekend Trips and Travel

Bulgaria's central location in the Balkans makes it an excellent base for exploring Southeast Europe. Weekend trips to neighboring countries are both easy and affordable—you can reach Istanbul by bus for €25, fly to Athens for €40-60, or take a train to Bucharest for under €20. Within Bulgaria, bus and train networks connect all major cities and tourist destinations at minimal cost, typically €10-20 for cross-country journeys.

Working Spaces: Coworking and Cafés

The digital nomad infrastructure in Bulgarian cities has developed rapidly, particularly in Sofia and Plovdiv. Professional coworking spaces offer flexible membership options ranging from €80-150 per month for unlimited access, with day passes available for €10-15. These spaces typically include high-speed internet, meeting rooms, printing services, and—crucially for building your professional network—a community of other remote workers and freelancers.

For those who prefer variety or don't need daily desk space, Bulgaria's café culture provides excellent alternatives. Many cafés actively welcome remote workers, offering reliable WiFi and comfortable seating for extended periods. It's completely acceptable to occupy a table for several hours with just a couple of coffee orders (€3-5 total), though considerate digital nomads often alternate between different locations or visit during off-peak hours.

Realistic Monthly Budget Scenarios

Minimal Budget (€800-1,000/month)

This budget works for digital nomads prioritizing savings, willing to live in suburban areas or smaller cities, cook most meals at home, and limit entertainment expenses. It includes:

- Shared accommodation or studio in non-central area: €300-400

- Groceries and occasional meals out: €200-250

- Utilities and internet: €60-80

- Transportation: €30-50

- Phone: €10-15

- Entertainment and miscellaneous: €100-150

- Healthcare: €50-80

Comfortable Budget (€1,200-1,600/month)

This mid-range budget allows for a one-bedroom apartment in a decent neighborhood, regular dining out, coworking space membership, and active social life:

- One-bedroom apartment, good location: €450-600

- Food (mix of cooking and restaurants): €300-400

- Utilities and internet: €70-100

- Transportation and occasional taxis: €50-80

- Coworking space or café working: €80-120

- Phone: €15

- Entertainment and activities: €150-250

- Healthcare: €80-120

Premium Lifestyle (€2,000-2,500/month)

For digital nomads earning strong income who want the best Bulgaria offers without excessive spending:

- Two-bedroom or premium one-bedroom, central location: €700-900

- Food with frequent restaurant dining: €450-600

- All utilities, high-speed internet, premium services: €100-150

- Flexible transportation including regular taxis: €100-150

- Premium coworking or private office: €150-200

- Phone with additional data: €20-30

- Entertainment, fitness, travel: €300-500

- Comprehensive healthcare: €120-180

Banking in Bulgaria: Complete Setup Guide for Digital Nomads

Successfully managing your finances as a digital nomad in Bulgaria requires understanding both the local banking landscape and modern digital banking alternatives. The good news is that Bulgaria offers multiple pathways to establish your banking infrastructure, whether you prefer traditional local banks or international digital banking solutions.

Traditional Bulgarian Banks for Foreigners

Several Bulgarian banks actively court international customers and offer services in English, though the account opening process requires patience and proper documentation.

UniCredit Bulbank

As Bulgaria's largest bank and part of the Italian UniCredit Group, Bulbank offers the most foreigner-friendly services among traditional banks. Their English-speaking staff in major cities can guide you through account opening, and they provide comprehensive online banking platforms with English interfaces.

Non-residents can open accounts, though requirements are stringent. You'll need your passport, proof of address (either in Bulgaria or your home country), and documentation explaining the source of your funds. Processing typically takes 1-2 weeks, and minimum initial deposits range from €100-500 depending on account type.

Monthly maintenance fees run €5-15, though these can be waived if you maintain minimum balances (typically €500-1,000) or meet monthly transaction requirements. International transfers cost €15-25 per transaction, making this option less ideal for freelancers receiving frequent international payments.

DSK Bank

DSK Bank (State Savings Bank) combines extensive branch networks throughout Bulgaria with increasingly digital services. While historically more bureaucratic, they've modernized significantly and now offer competitive services for foreigners.

Account opening requirements mirror UniCredit Bulbank, with similar documentation needs and processing times. Their advantage lies in their extensive ATM network throughout Bulgaria, which proves valuable if you travel extensively within the country.

First Investment Bank (Fibank)

Fibank targets a younger, more tech-savvy demographic and offers relatively streamlined digital banking services. Their mobile app receives generally positive reviews from expat users, and they've simplified their account opening process compared to some competitors.

International wire transfer fees at Fibank are slightly lower than larger banks (€12-20), and their currency exchange rates are competitive, making them worth considering if you frequently convert between euros, Bulgarian lev (BGN), and other currencies.

Challenges with Traditional Bulgarian Banking

Before committing to a local Bulgarian bank account, understand the potential frustrations. Language barriers persist despite English-speaking staff—complex issues often require Bulgarian fluency or bringing a translator. Banking hours remain traditional (9 AM - 5 PM weekdays), making in-person visits challenging if you work standard hours.

The Bulgarian banking system operates with a certain... let's call it "thoroughness"... regarding documentation. Be prepared for requests that might seem excessive by Western European standards. The phrase "this is Bulgaria" will become familiar as you navigate processes that seem designed in another era.

Currency considerations also matter. Bulgaria uses the Bulgarian Lev (BGN), which is pegged to the Euro at approximately 1.96 BGN = 1 EUR. While Bulgaria plans to adopt the Euro (postponed multiple times, currently targeted for 2025 or later), you'll need to manage currency conversion for now. Most Bulgarian banks hold your funds in BGN, requiring conversion fees for euro or dollar transactions.

Digital Banking Solutions: The Smart Alternative

Most digital nomads in Bulgaria bypass traditional banks entirely, relying instead on modern digital banking platforms that offer superior functionality for international work and lifestyle.

Wise (formerly TransferWise)

Wise has become the default banking solution for many digital nomads in Bulgaria, and for good reason. The platform offers Bulgarian residents the ability to hold and manage money in 50+ currencies, receive local bank details for EUR, GBP, USD, and other major currencies (enabling clients to pay you as if you had a local bank account), and convert between currencies at real exchange rates with minimal fees (typically 0.35-0.65%).

For freelancers receiving international payments, Wise solves multiple problems simultaneously. Clients can pay you in their local currency without worrying about international transfer fees, you can hold money in the currency you earned it until you need it (avoiding forced conversions), and you can spend directly in Bulgaria using the Wise debit card with excellent exchange rates.

Setting up Wise requires only digital identity verification—you can complete the entire process online in 10-15 minutes. The Wise debit card arrives within 1-2 weeks and works at all Bulgarian ATMs and point-of-sale terminals. Monthly maintenance fees don't exist; you only pay for transactions and currency conversions you actually make.

Revolut

Revolut offers a more comprehensive "lifestyle banking" approach, combining core money management with budgeting tools, cryptocurrency trading, stock investments, and travel insurance options. For digital nomads, key features include:

Multi-currency accounts with instant exchange at interbank rates (up to certain monthly limits on free plans), virtual cards you can create instantly for online purchases, built-in budgeting and spending analytics, and integration with Apple Pay, Google Pay, and other payment platforms.

Revolut's free plan provides excellent value, though Premium (€7.99/month) or Metal (€13.99/month) plans unlock additional benefits like higher ATM withdrawal limits, better exchange rate allowances, and travel insurance that can justify the cost for frequent travelers.

The account setup process is entirely digital and typically takes 10 minutes. Revolut approves accounts faster than Wise in most cases, often providing instant provisional approval with full access granted within 24-48 hours.

Juuli: Purpose-Built for European Freelancers

While Wise and Revolut serve digital nomads well, Juuli specifically targets freelancers and remote workers operating in European markets. The platform understands the unique needs of location-independent professionals and builds features accordingly.

Juuli's core advantages for Bulgarian-based digital nomads include no company registration requirements for account opening (unlike some banking solutions that require proof of business registration), invoicing tools integrated directly into the banking platform (create, send, and track invoices while managing the payments in one system), and payment gateway integration for freelancers who receive payments through their own websites or platforms.

The Juuli Visa Card functions as a standard business debit card throughout Europe, including Bulgaria, with transparent fee structures designed for international freelancers. Unlike traditional banks that nickel-and-dime international transactions, Juuli charges clear, upfront fees with no hidden costs.

Perhaps most importantly, Juuli operates on a pay-as-you-go model rather than monthly subscription fees. You only pay for the services you actually use—if you send five invoices and receive three international payments in a month, you pay for exactly that. No activity means no fees, making it ideal for freelancers with variable income and workflow.

The platform also offers multi-currency support, allowing you to hold and manage euros, dollars, pounds, and other currencies without forced conversions. This proves invaluable when working with international clients—you can receive payment in USD from American clients, GBP from UK clients, and EUR from European clients, then convert to BGN only when you need to pay Bulgarian expenses.

Hybrid Banking Strategy: The Best Approach

Most successful digital nomads in Bulgaria don't choose one banking solution—they use a strategic combination that covers all their needs while minimizing fees and maximizing flexibility.

The Recommended Setup:

Primary Account: Wise or Juuli for receiving international client payments, managing multiple currencies, and handling most day-to-day expenses. Wise excels at simple, reliable money transfers and currency conversion. Juuli adds sophisticated invoicing and payment gateway features that prove invaluable for freelancers running more complex operations.

Secondary Account: Revolut for daily spending, budgeting tools, and backup card when traveling. The instant card creation feature proves incredibly useful if your primary card gets compromised or lost.

Optional Local Account: Bulgarian bank only if you need it for specific purposes like signing a lease (some landlords still insist on local bank transfers), setting up utility payment direct debits (some providers prefer local bank accounts), or receiving payments from local Bulgarian clients (some prefer domestic bank transfers).

This hybrid approach costs approximately €5-15 per month total (mostly from occasional transaction fees rather than subscription costs), covers every banking need you'll encounter, provides redundancy if one service has issues, and optimizes for minimal fees on international transactions.

Opening Your Digital Bank Accounts: Step-by-Step

For Wise:

Download the Wise app or visit wise.com and click "Register." Choose personal or business account based on your needs (most freelancers start with personal). Enter your email, create a password, and verify your email address. Provide personal information including full name, date of birth, address, and phone number.

Upload identity verification documents—typically passport or national ID, plus a selfie for facial recognition. This process usually completes instantly. Add your first currency and deposit a small amount (can be as little as €10) to activate the account. Order your Wise debit card (one-time fee of approximately €7-10) and wait 1-2 weeks for delivery to your Bulgarian address.

For Revolut:

Download the Revolut app from iOS App Store or Google Play. Enter your phone number and verify via SMS code. Provide personal details including full name, date of birth, and address. Take a selfie and upload a photo of your identity document for verification.

Revolut's AI-powered verification usually approves accounts within minutes, though some cases require manual review (24-48 hours). Choose your plan (Standard free plan is excellent for most digital nomads). Order your Revolut card (usually free, though delivery to Bulgaria might incur €5-10 fee). The card typically arrives within 1-2 weeks.

For Juuli:

Visit Juuli's website and click "Get Started" or "Open Account." Enter your email and basic information about your freelance work. Juuli's streamlined onboarding focuses on understanding your business needs rather than excessive bureaucratic requirements.

Verify your identity with standard documentation (passport/ID, proof of address). Describe your freelance business and typical payment patterns—this helps Juuli set up your account appropriately and isn't a barrier to approval. Add initial funding (usually minimum €20-50 to activate services).

Request your Juuli Visa Card, which arrives within 1-2 weeks to addresses throughout Europe. Set up invoicing templates and payment methods if you plan to use Juuli's integrated business tools.

Tax Considerations for Digital Nomads in Bulgaria

Understanding your tax obligations is crucial, though this guide provides general information rather than specific tax advice (always consult a qualified tax professional for your situation).

Bulgarian Tax Advantages

Bulgaria offers one of the most favorable tax environments in the European Union, particularly for digital entrepreneurs and freelancers. The country's 10% flat income tax rate is the lowest in the EU, applying equally to all income levels. Compare this to progressive tax rates in Western Europe that often start at 20-25% and climb above 40-50% for high earners.

Corporate tax also stands at 10% flat rate for businesses registered in Bulgaria. For freelancers considering company formation, this creates attractive opportunities for tax optimization within legal frameworks.

Bulgaria also offers relatively generous tax treaties with many countries, potentially avoiding double taxation for those maintaining tax residency elsewhere while working in Bulgaria temporarily.

Tax Residency Rules

Bulgaria considers you a tax resident if you spend more than 183 days in the country during a calendar year, or if Bulgaria represents your "center of vital interests" (essentially, where you have the strongest personal and economic ties). Tax residents pay Bulgarian taxes on worldwide income. Non-residents only pay Bulgarian taxes on income sourced from Bulgaria.

Most digital nomads working for international clients while living in Bulgaria operate in a gray zone. Technically, if you're a Bulgarian tax resident working remotely, you should register as self-employed (ET status or "едноличен търговец") or through a limited company (EOOD) and pay the appropriate Bulgarian taxes.

Reality proves more complex. Many digital nomads maintain tax residency in their home countries and treat Bulgaria as a temporary base, especially if staying less than 183 days annually. Others register officially in Bulgaria to access the favorable tax rates and establish legal residency.

Registering as Freelancer in Bulgaria

If you decide to establish official freelance status in Bulgaria, the process is surprisingly straightforward compared to many EU countries.

You can register as ET (едноличен търговец - sole proprietor) through the Bulgarian Registry Agency. This requires a local address, identity documents, and approximately €50-100 in registration fees. Processing takes 1-2 weeks. Once registered, you pay 10% income tax on profits (after business expenses) plus mandatory social security contributions (approximately €100-250/month depending on your declared income base).

Alternatively, you can establish an EOOD (limited liability company), which provides more legal protection and can be more tax-efficient at higher income levels. This process is more complex and typically requires legal assistance, costing €500-1,000 for setup.

Practical Banking While Managing Tax Obligations

Regardless of your tax status, proper financial record-keeping is essential. Digital banking platforms like Wise, Revolut, and Juuli make this significantly easier than traditional banking.

All three platforms provide detailed transaction histories that export easily to spreadsheets or accounting software. You can categorize expenses, tag transactions, and generate reports that simplify tax filing whether you're reporting in Bulgaria or your home country.

Juuli's integrated invoicing system provides particular advantages here—your invoice records and payment receipts exist in one system, automatically creating a complete paper trail of your freelance income. This becomes invaluable during tax season or if you ever face an audit.

Cultural and Practical Banking Tips

Understanding some cultural context will smooth your banking and financial life in Bulgaria:

Cash Still Matters: While Bulgaria has modernized rapidly, cash remains important, especially outside major cities. Keep 50-100 BGN in cash for small purchases, traditional markets, and occasional businesses that prefer cash. Your Wise, Revolut, or Juuli card will work at virtually all ATMs, though be aware that Bulgarian ATMs sometimes have withdrawal limits of 400-800 BGN per transaction.

Tipping Culture: Restaurant service charges aren't typically included in bills. A 10% tip is standard for good service. For taxi drivers, rounding up to the nearest lev is appreciated but not obligatory. Digital payment platforms make splitting bills with friends easy—Revolut particularly excels at this with built-in bill-splitting features.

Payment Methods: Bulgarian businesses increasingly accept card payments, even for small amounts. However, always carry some cash as a backup. Contactless payment works everywhere that accepts cards, and daily limits are generous (typically 100+ BGN without PIN).

Currency Exchange: Never exchange currency at airport kiosks—rates are terrible. If you need physical cash immediately upon arrival and don't yet have a local card, exchange just enough for your first day, then use ATMs with your digital banking card for better rates. Wise, Revolut, and Juuli all offer substantially better exchange rates than traditional currency exchange services.

Setting Up Financial Success in Bulgaria: Your Action Plan

Week 1: Preparation (Before Arrival)

Open Wise account and order card to your current address, allowing time for it to arrive before departure. Open Revolut account (can be delivered to Bulgarian address after arrival). Research Juuli and determine if its freelancer-focused features match your needs. Begin compiling documents needed for any local banking or residency registration.

Week 2-3: Initial Settlement

Secure accommodation with address you can use for banking and official purposes. Obtain Bulgarian phone number (essential for many local services and two-factor authentication). Receive your Wise and/or Revolut cards and activate them. Order Juuli card if you decided to use it, providing your new Bulgarian address.

Week 4-6: Banking Infrastructure Completion

Set up your preferred spending patterns (which card for which purposes). Test all cards at local ATMs, shops, and restaurants to ensure they function properly. Configure your digital banking apps with budgets, categories, and any automated features you want to use. Research and select a local Bulgarian bank if you determine you need one for specific purposes.

Ongoing: Optimization and Management

Monitor exchange rates and optimize when you convert between currencies. Track expenses carefully using your banking app features. Keep records of all income and business expenses for tax purposes. Join digital nomad communities in Bulgaria to learn from others' banking and financial experiences. Stay updated on Bulgarian banking regulations and any changes to digital banking platforms.

Conclusion: Bulgaria Offers Unmatched Value for Digital Nomads

The combination of low cost of living and sophisticated banking infrastructure makes Bulgaria an exceptional base for digital nomads and remote workers in 2025. You can maintain a comfortable lifestyle on €1,200-1,600 monthly, enjoy a vibrant cultural scene, and easily manage your international finances through digital banking solutions.

The banking landscape has evolved dramatically over the past five years. Where once you had no choice but to navigate frustrating traditional bank bureaucracy, you now have multiple excellent options through platforms like Wise, Revolut, and Juuli that understand and cater to the unique needs of location-independent professionals.

Whether you're considering Sofia's entrepreneurial energy, Varna's beachside lifestyle, or Plovdiv's artistic community, Bulgaria offers the rare combination of very low living costs, excellent quality of life, and the practical infrastructure needed to run a successful international freelance or remote career.

The key to success lies in approaching your Bulgarian adventure with realistic expectations, proper preparation, and the right banking infrastructure. With €2,000-2,500 monthly, you can live extremely well while saving significantly compared to Western European or North American cities. And with modern digital banking, you can manage your international finances as easily from Sofia as you could from London or Berlin—except you'll keep significantly more of your earnings.